2022 marked a significant year for the Singaporean property market, particularly for those interested in Executive Condominiums (ECs) under the Ec Price Singapore 2022 framework. The year saw the introduction of new guidelines for potential homeowners, including a minimum 5% downpayment, capped by the Housing & Development Board (HDB), and an adjustment of the Loan to Value (LTV) ratio to 75%. First-time buyers, especially those utilizing public housing schemes, had access to the HDB Loan with a maximum financing limit of 75% of the EC value, determined by their income. The Mortgage Service Report (MSR) stood at 30% for HDB flats or ECs and 35% for private properties, emphasizing financial prudence. Prospective EC owners were advised to consider both fixed and variable mortgage options, with the CPF being a significant financial resource for the downpayment and subsequent mortgage payments. Additional government grants like the AHG and PHG were available to assist with financing. Homeowners must manage their mortgages diligently, considering refinancing options to lower interest payments and monthly commitments. Regularly assessing home loan performance against current rates is essential in the dynamic Ec Price Singapore 2022 market. Staying informed and planning financially is key to navigating this market responsibly.

2022 marks a pivotal year for prospective homeowners in Singapore, particularly those eyeing an Executive Condominium (EC). This article dissects the nuances of EC downpayments and mortgages, guiding first-time buyers through the financial landscape. We’ll explore the latest trends in EC prices in Singapore for 2022, delve into HDB loan eligibility alongside CPF usage, and assess affordability with the Mortgage Servicing Ratio (MSR). From evaluating fixed-rate and variable-rate mortgage options to formulating a savings strategy for your downpayment, this comprehensive guide offers actionable insights. Additionally, we’ll provide strategies for managing your mortgage post-purchase, covering budgeting and refinancing advice tailored for EC owners. Whether you’re at the cusp of homeownership or looking to make informed financial decisions, this article is your guide to navigating the complexities of EC financing in 2022.

- Understanding the EC Downpayment Landscape in Singapore for 2022

- Navigating the HDB Loan Eligibility and CPF Usage for First-Time Homebuyers

- Assessing Affordability: What You Need to Know About Mortgage Servicing Ratio (MSR) in 2022

- EC Financial Schemes: Exploring the Fixed-Rate and Variable-Rate Options for 2022

- Strategic Planning: Saving for Your Executive Condominium Downpayment in Singapore

- Tips for Managing Your Mortgage Post-Purchase: Budgeting and Refinancing Insights for EC Owners

Understanding the EC Downpayment Landscape in Singapore for 2022

In 2022, navigating the Ec price landscape in Singapore for potential homeowners involves a clear understanding of the downpayment and mortgage options available. The Executive Condominium (EC) scheme is designed to cater to the middle-income group, offering them a pathway to own a larger and more luxurious home than what they could afford under the public housing scheme. Prospective buyers should be aware that for ECs, the minimum downpayment required has been set at 5% of the purchase price, provided that the amount does not exceed the price limit set by the Housing & Development Board (HDB). It’s crucial to consider the total cost including the downpayment, as this will significantly impact your financial planning. Additionally, the loan-to-value (LTV) ratio for ECs has been adjusted, allowing Singaporeans to finance up to 75% of the purchase price in 2022, a change that reflects the dynamic nature of the property market.

Moreover, understanding the EC downpayment and mortgage landscape also necessitates keeping abreast of the prevailing interest rates and the total debt servicing ratio (TDSR) framework, which governs how much an individual can borrow for a new home loan. The Ec Price Singapore 2022 can fluctuate due to various factors such as economic conditions, supply and demand dynamics, and government cooling measures. As such, potential EC buyers should conduct thorough research and engage with financial advisors to tailor their mortgage and downpayment plans accordingly. With the right planning and a comprehensive understanding of the current market conditions, buyers can navigate the EC landscape in Singapore effectively, ensuring they make informed decisions about one of their most significant investments.

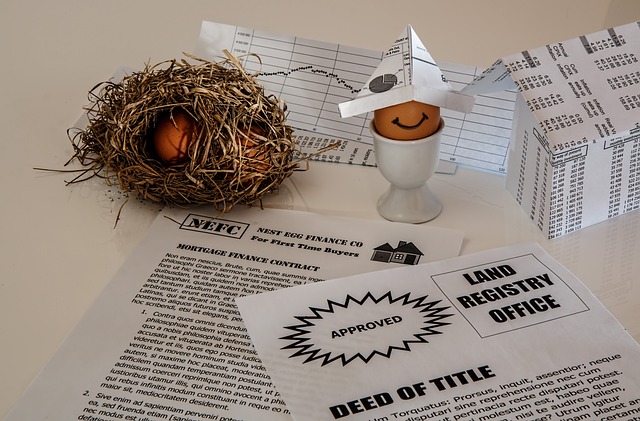

Navigating the HDB Loan Eligibility and CPF Usage for First-Time Homebuyers

When considering the EC (Executive Condominium) downpayment and mortgage landscape in Singapore for first-time homebuyers, understanding the HDB Loan Eligibility is paramount. In 2022, the Housing & Development Board (HDB) loan serves as a viable option for eligible applicants looking to purchase an EC under the public housing scheme. Prospective buyers should be aware that they must meet specific criteria to qualify for this loan, including being first-time homebuyers and not owning any residential property at the time of application. The HDB Loan Scheme offers a maximum loan amount capped at 75% of the EC value as per the Ec Price Singapore 2022 figures, subject to a valuation of the flat by HDB or the market valuation, whichever is lower. Additionally, the monthly income ceilings and total debt servicing ratio (TDSR) have been set to ensure financial prudence.

Complementing the HDB Loan, CPF (Central Provident Fund) usage for the downpayment is a significant aspect for many Singaporeans. First-time homebuyers can use their CPF Ordinary Account (OA) savings for the downpayment of an EC. In 2022, the CPF OA withdrawal limit for first-timers purchasing an EC has been enhanced to provide more financial flexibility. This allows buyers to leverage their CPF savings, which can be a substantial portion of the downpayment, reducing the need for additional cash outlay. It’s advisable for buyers to calculate the amount they can utilize from their CPF OA and understand the associated terms and conditions to ensure they make informed decisions when purchasing an EC. The confluence of HDB Loan Eligibility and CPF usage options underscores the support available to first-time homebuyers in Singapore’s property market, which is further reflected in the Ec Price Singapore 2022 figures.

Assessing Affordability: What You Need to Know About Mortgage Servicing Ratio (MSR) in 2022

In 2022, homebuyers in Singapore are navigating a dynamic property market where understanding the Mortgage Servicing Ratio (MSR) is crucial for assessing personal affordability. The MSR sets a cap on the amount of one’s monthly income that can be used to service all types of outstanding credit, including mortgages, which ensures buyers do not overextend themselves financially. According to the Monetary Authority of Singapore (MAS), the MSR is capped at 30% of a borrower’s monthly income for property owners living in a HDB flat or an executive condominium (EC). For private properties, this ratio is even more stringent at 35%. Prospective buyers must carefully consider their financial situation and adhere to these guidelines when planning for an EC downpayment in Singapore. In light of the EC price trends in 2022, it’s evident that potential homeowners must perform a thorough self-assessment to determine what they can realistically afford, considering factors such as monthly mortgage payments, other financial obligations, and personal savings. By understanding and applying the MSR as part of their financial planning, buyers can make informed decisions that align with their long-term financial goals within the Singapore property market landscape of 2022.

EC Financial Schemes: Exploring the Fixed-Rate and Variable-Rate Options for 2022

In 2022, the Housing & Development Board (HDB) in Singapore continues to offer Executive Condominium (EC) financial schemes that cater to the diverse needs of homebuyers. Prospective EC owners have the option to choose between fixed-rate and variable-rate mortgage packages when financing their homes. The fixed-rate scheme provides an interest rate that remains constant over a predetermined period, offering predictability in your monthly repayments. This can be particularly advantageous for those who prefer budget stability and are adverse to the fluctuations of the market. On the other hand, the variable-rate option allows your interest rate to change in tandem with market conditions, which could potentially mean lower payments if rates fall, but also higher payments if rates rise. When considering an EC in Singapore for 2022, it’s crucial to evaluate your financial situation and market trends to decide which mortgage type aligns best with your long-term financial planning. The EC prices in Singapore have been a subject of interest among potential buyers, as the property market continues to evolve. Keeping abreast of the latest EC pricing in 2022, as well as understanding the nuances of the fixed and variable-rate mortgage options, will equip you with the knowledge necessary to make an informed decision.

Strategic Planning: Saving for Your Executive Condominium Downpayment in Singapore

When embarking on the journey to secure an Executive Condominium (EC) in Singapore, strategic planning for your downpayment is paramount. Prospective homeowners must consider the EC prices in Singapore as they have been on a gradual rise; staying abreast of the EC price trends in 2022 will be crucial for effective financial planning. To strategize effectively, start by assessing your current financial situation, including your savings, income, and any other assets. This will help determine your budget and how much you need to save for the downpayment. The CPF (Central Provident Fund) is a significant resource for EC buyers in Singapore, as it allows you to use a portion of your savings for the downpayment and monthly mortgage payments. To maximize your CPF utilization, familiarize yourself with the withdrawal limits and how they apply to EC purchases.

In addition to leveraging your CPF, consider adopting a multi-faceted saving approach. This could involve setting up a high-interest savings account specifically for your EC downpayment, cutting non-essential expenses, and exploring investment opportunities that can yield returns without significant risk. Additionally, take advantage of government grants available for first-time EC buyers, such as the Additional CPF Housing Grant (AHG) or the Proximity Housing Grant (PHG), which can significantly offset purchase costs. By staying informed on EC Price Singapore 2022 and actively planning your savings, you’ll be better positioned to secure your dream home without compromising your financial well-being.

Tips for Managing Your Mortgage Post-Purchase: Budgeting and Refinancing Insights for EC Owners

As an EC (Executive Condominium) owner in Singapore, managing your mortgage post-purchase is crucial to maintaining financial stability and ensuring that you can continue to meet your obligations without undue strain. One of the first steps after securing your unit at the EC Price Singapore 2022 is to create a detailed budget that accounts for all recurring expenses associated with homeownership. This includes mortgage repayments, maintenance fees, property taxes, and insurance premiums. By tracking your income and expenditures diligently, you can anticipate cash flow challenges and plan accordingly. It’s advisable to allocate funds for unforeseen repairs or renovations to avoid financial surprises.

Refinancing your mortgage could be a strategic move to reduce interest payments and lower monthly commitments. Keep abreast of the mortgage landscape in Singapore, as competitive rates and better loan features may become available over time. EC owners should monitor their home loan’s performance against prevailing rates, especially if there have been significant changes in the EC Price Singapore since your purchase. If you find that refinancing could offer substantial savings or more favorable terms, it may be worth considering a switch to optimize your financial situation. Always weigh the costs and benefits of refinancing, as each individual’s circumstances differ, and what is optimal for one may not be for another. Stay informed about the financial market trends and consult with a mortgage specialist to explore your options and make an informed decision that aligns with your long-term financial goals.

In conclusion, navigating the EC downpayment and mortgage landscape in Singapore for 2022 requires a comprehensive understanding of the available financial schemes, HDB loan eligibility, CPF usage, and the Mortgage Servicing Ratio (MSR). Prospective EC owners must strategically plan their finances to ensure affordability and long-term financial stability. With the EC prices in Singapore for 2022 remaining a significant investment, it is imperative to explore both fixed-rate and variable-rate options to suit individual financial profiles. Post-purchase, managing your mortgage effectively through budgeting and considering refinancing when opportune can lead to substantial savings over the loan tenure. By keeping abreast of these financial considerations, first-time homebuyers can confidently enter the property market with a clear vision of their EC ownership journey ahead.